Investor Experience Index: The Pre/Post Investment Communication Gap (Q1 2025)

Never miss an Invest Clearly Insights article

Subscribe to our newsletter today

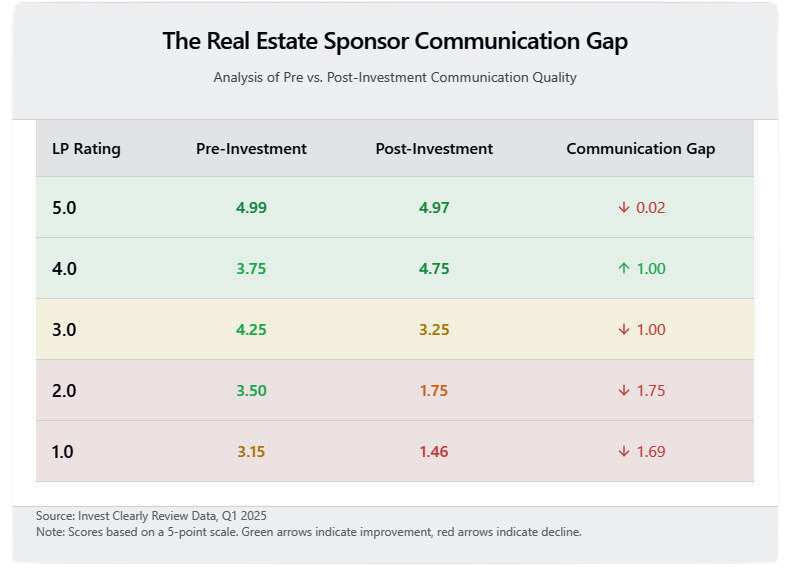

In an analysis of limited partner reviews, a concerning pattern emerges in real estate sponsor-investor relationships: the notable disparity between pre and post-investment communication quality.

While most sponsors excel during the fundraising phase, averaging pre-investment communication scores above 3.0 even in otherwise poorly-rated investments, these scores drop dramatically after capital is committed. This "communication cliff" is most pronounced in poorly-rated investments, where post-investment communication scores plummet by up to 1.75 points on a 5-point scale.

The data reveals three distinct tiers of sponsor performance:

Elite Performers:

- Maintain consistent communication quality throughout the investment lifecycle

- Show minimal drop-off between pre and post-investment metrics

- Average 4.99 pre-investment and 4.97 post-investment scores

Middle Tier:

- Experience moderate communication decline post-investment

- Maintain acceptable but reduced engagement levels

- Show varied performance across metrics

Underperformers:

- Display the sharpest decline in communication quality

- Pre-investment scores average 3.15, dropping to 1.46 post-investment

- Often accompany misaligned expectations and leadership concerns

The Size Paradox

Further analysis reveals a counterintuitive relationship between sponsor size and investor satisfaction. Despite having greater resources for investor relations, the largest sponsors (>$1B AUM) show notably lower satisfaction rates, averaging 2.92 overall compared to 4.79 for mid-sized sponsors ($500M-1B).

This "size paradox" appears most pronounced in post-investment communication:

- $500M-1B sponsors: 4.77 pre-investment rises to 4.82 post-investment

- <$100M sponsors: Maintain consistent 5.00 ratings across both phases

- $1B AUM sponsors: 4.08 pre-investment drops to 3.17 post-investment

Mid-sized sponsors appear to hit a sweet spot, combining institutional-quality resources with maintained personal attention. This suggests that communication challenges may be more about scalability than resources, with larger organizations potentially struggling to maintain the personal touch that characterizes successful investor relations.

For LPs, this analysis underscores the importance of investigating a sponsor's long-term investor relations track record. High-touch fundraising communication, while common, may not translate to sustained engagement throughout the investment period. The data particularly suggests that size and resources alone don't guarantee better investor communication - and may actually predict the opposite.

Written by

Invest Clearly empowers you to make informed decisions by hosting unbiased reviews of passive investment sponsors from verified experienced investors.

Other Articles

Why Investor Voices Matter More Than Ever

Industry analysts have described a “data transparency crisis” in private markets, citing fragmented reporting, inconsistent data standards, and limited comparability across managers. This matters because limited visibility affects how investors assess sponsors, price risk, and respond when execution diverges from expectations.

Investor Experience Index: 2025 Wrap Up

We’ve analyzed review data from 2025 to uncover surprising trends in private real estate.

The New Approach to Sponsor Due Diligence in Private Real Estate

Start your due diligence with the sponsor and the business plan before focusing on the real estate asset.

Is Private Equity Coming to Your 401(k)?

A new executive order could lead to private markets getting access to 401(k) capital. Learn how a new wave of capital and liquidity demands could affect private real estate.

What 2025 Fundraising Data Reveals About LP Capital Allocation in Private Real Estate

Private real estate fundraising saw a rebound in 2025, marking the first year-over-year increase in annual capital raised since 2021. According the PERE Fundraising Report Full Year 2025, total fundraising reached $222 billion, up 29 percent from the $172.4 billion raised in 2024.

Limited Partners in Private Real Estate and Private Investments

If you’re exploring private real estate investing, you’ve likely encountered the term “limited partner” or “LP.” Understanding this role is essential before committing capital to any private market fund